ELECTRICITY OPPORTUNITY

Powering portfolios with the fastest-growing commodity in the U.S. economy

INVESTORS: INSTITUTIONAL

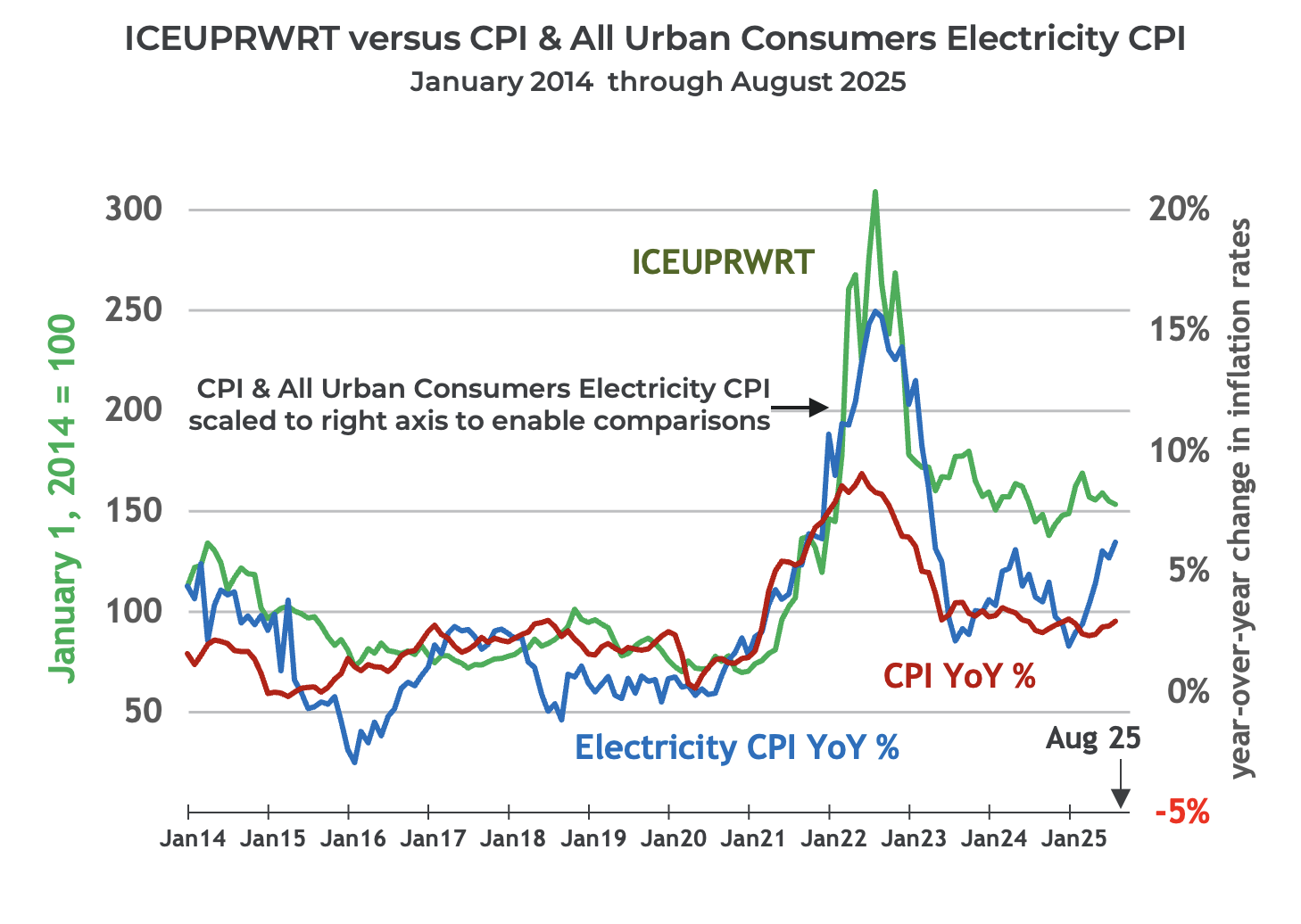

Inflation Protection

Electricity is 2.50% of the monthly US CPI. For institutions to have a meaningful commodity allocation, a portion of AUM should be dedicated to electricity

Portfolio Diversification

Electricity is not correlated to any major asset class (equities and debt); by including electricity in a commodity allocation, returns are not associated with existing allocations

INVESTORS: RETAIL

Evolving Portfolio Models

The “60/40” model (60% stocks/40% bonds) is now being updated to 60/35/5, with 5% allocation to commodities. A 60/35/3/2 (3% commodities + 2% electricity) provides better long-dated risk-adjusted returns

Opportunity

With AI, data centers, bitcoin and overall US growth hitting the headlines every day, ICEUPWRT provides the only way to meaningfully participate in the commodity – electricity – that is linked to every headline

| Model Portfolio Returns and Risk Metrics 01 Jan 2018 – 30 Jun 2025 |

|||||

|---|---|---|---|---|---|

| 60% Equity / 40% Debt | 60% Equity / 35% Debt / 5% BCOM | 60% Equity / 35% Debt / 5% GSCI | 60% Equity / 35% Debt / 3% BCOM / 2% Power | 60% Equity / 35% Debt / 3% GSCI / 2% Power | |

| Annualized Returns | 14.89% | 15.01% | 15.14% | 15.25% | 15.28% |

| Sharpe Ratio | 1.16 | 1.16 | 1.15 | 1.18 | 1.18 |

Commodities improve a 60/40 Model Portfolio

Power improves a Model Portfolio + Commodities

INVESTORS: TACTICAL

Smart Beta

Savvy investors can use ICEUPWRT to selectively add exposure to existing commodity portfolios, thereby adding “Smart Beta” – or commodity exposures beyond the normal indexes

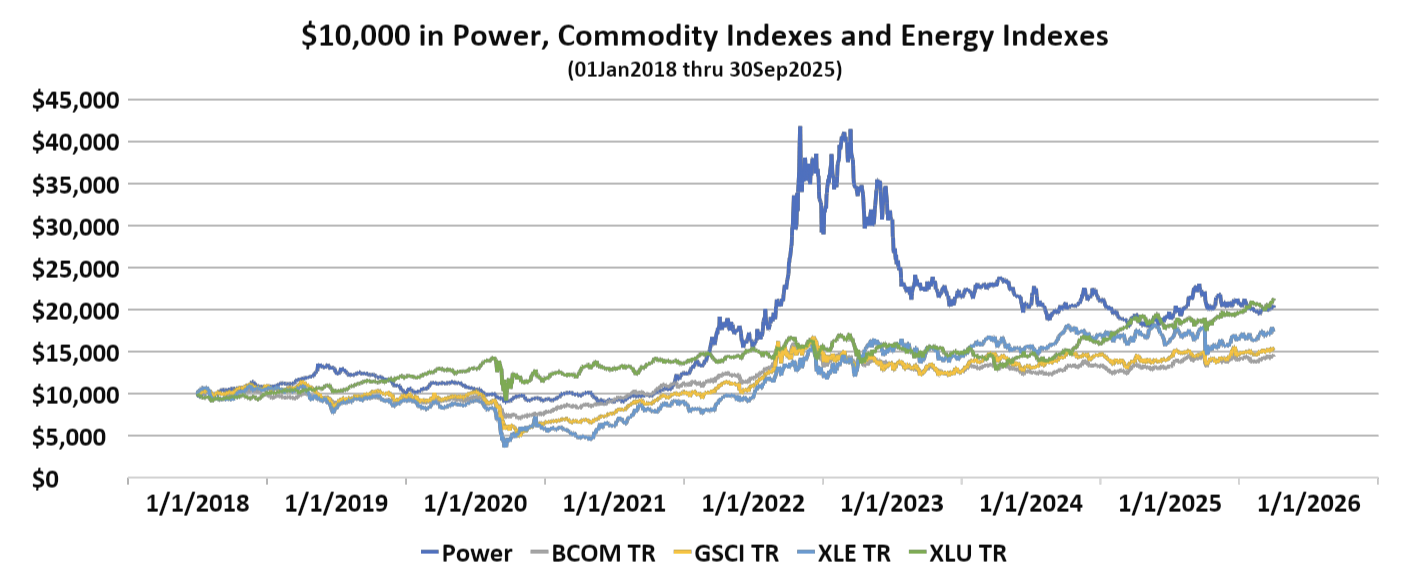

Power Compared to Existing Energy Products

Seasonal Cyclical

Investors with keen insights (fundamental and/or technical) can use electricity to add alpha to portfolios

Situational

Power Added to Existing Commodity Products

As the most volatile commodity in the world, electricity can be used as a trading or speculative vehicle for sophisticated players